At a high level, the genesis for this post should seem obvious to most of you: short-form video content is addictive. The reason why it’s addictive is that it’s much easier to refresh your dopamine cycle when you’re able to cycle through 10+ videos in a ~5-minute session versus 1-2 hour long move. The “hit rate” for finding compelling content as a user of a platform like TikTok is much higher than on a platform like Netflix. That said, I want to focus on the underlying reason these platforms can fight for our attention and how the “TikTok model” can tell us a lot about the success of other companies.

The secret of TikTok is through something called Signal Liquidity.1 Think about your typical social media “newsfeed” as operating according to the following formula:

You open up an app and begin browsing or consuming content

It collects “data” on what kinds of content you seem to engage with (e.g., how long you sit through a video)

It parses this data to look for “signals” (e.g., are you watching videos of similar length more often than others, are you gravitating toward content tagged with a particular keyword, etc.)

It then pushes content to your feed that either:

Other users of the platform who exhibit similar signals to yourself engaged positively with

Content that is tagged with keywords / topics / markers which align with your signals

Depending on your reaction to this content, the platform attempts to better refine what content will keep you engaged on the platform the longest

Rinse and repeat

Simple enough, right? I’m sure most people are familiar with this basic notion of an “algorithmically-driven” social media platform. What’s important though, I think, is to understand what makes certain platforms vastly superior to others from the perspective of engagement.

I see the goal of any platform as twofold:

Collect enough data on users such that you can sell said data to advertisers

Refine an algorithm enough such that users are fed content that they engage with – thereby keeping them on the platform and preventing them from diverting their attention elsewhere

To turn back to that term I threw out before, the Signal Liquidity of a platform is a measure of the volume of signals that come from a user in one session on said platform. Let’s illustrate this through a comparison between the typical viewing experience on Netflix and TikTok.

On Netflix, a user’s session probably ends up looking like this:

You scroll through the Netflix “feed” looking for a show to watch

You settle on a piece of content and start watching for ~10 minutes

After deciding if you like it or not you either:

Continue watching

Switch to something else

Eventually, you either:

Settle on something you like and continue watching said thing

Leave to find content on another platform

Throughout this experience, Netflix is only able to gauge a couple of things:

How long you watched content for

What kind of content you looked at

Potentially, whether or not you liked said content

This “feedback loop” occurs in 10-20 minute (if not longer) intervals. Compared to other platforms, the feedback engine is too slow. This is why a platform like Netflix has such massive content spend: They have to create an experience for the user to come onto the platform. Netflix is not necessarily trying to compete with your Twitter feed, they’re in the business of making sure you don’t turn on the new Amazon Prime show. That is, only until they realize that the value to the user of 45mins on TikTok is equivalent to a single episode of Squid Game.

On TikTok, a user’s session probably ends up looking like this:

You open the app to your feed

You begin to watch a video and perhaps:

Scroll through it

Watch the whole thing once

Check the comments

Like the video

Choose to share the video

Then, you might:

Scroll to another video

Watch the whole thing more than once

Look at videos by the same creator

Look at videos with the same background sound

Search for a similar video

Once that’s complete you then move on to another video, repeating this cycle

Tiktok is a platform with significantly more Signal Liquidity than Netflix. Per minute spent on the platform, the volume of signals generated by a TikTok session is much higher than that of Netflix. The feedback loop here is much shorter – in one session TikTok can garner hundreds (if not thousands) of signals from a user. Think about extending this observation to other content platforms. There’s a reason why Instagram, YouTube, and Facebook of the world have a significant advantage when it comes to keeping users engaged on their platforms. The greater the Signal Liquidity of a platform, the shorter the feedback loop is and the more incentive there is for the user to stay engaged.

Here’s a nice analogy from Scott Galloway:

Anyway, if data is the new oil, algorithms are the refineries, and signals make the oil lighter, sweeter, and more valuable.

The advantage a platform like TikTok receives from the volume of signals it collects is twofold:

It’s able to collect much more data per minute than another platform (thereby efficiently achieving goal #1 I laid out above)

It increases the switching cost for a user to leave a platform (thereby achieving goal #2)

By switching cost here, I mean the monetary / psychological / effort / time / etc. cost of switching from one app / product to another

For example, an app that keeps you highly engaged would have high switching costs (put differently, the amount of engagement you’d need to find on another platform to switch over is very high)

I think point #1 is fairly easy to understand. The revenue model for these companies is built upon selling ads. The more data the platform collects, the more lucrative ad spend becomes on the platform. In conjunction with this, it’s important to understand that these platforms aren’t really competing on a “content basis” they’re instead competing on an “attention basis.” The formula for a platform is simple:

Feed better targeting to advertisers ➡️ keep users on the platform for longer ➡️ users are served more ads

The key here is that the real hurdle for the platform is to get you to log on in the first place

The more effective a platforms feedback engine is, the more likely you are to gravitate toward it (see here)

Think of developing a model of agency for a user of a platform. When you turn on your phone you’re greeted with a choice: should I scroll through Instagram, TikTok, YouTube, Reddit, or Twitter right now? Once you pick a platform, that platform needs to serve you enough compelling content such that you’re disincentivized to leave the platform. Essentially, the more tailored the dopamine hits are from a platform and the quicker they come, the longer you will stay on said platform.

When you open up TikTok, the number of signals generated (beyond those it probably shouldn’t be collecting) is far greater than any other platform. The ingeniousness of TikTok’s addiction engine is precisely its Signal Liquidity. TikTok is so successful at collecting and dissecting signals, it’s able to increase the switching costs of leaving the platform to a level higher than the benefit provided by other platforms.

Keeping this in mind, let’s explore how the concept of signal liquidity and switching costs translates into identifying the success of other businesses. In general:

Businesses with high signal liquidity are, on the margin, more effective at serving tailored products to their customers compared to their competitors

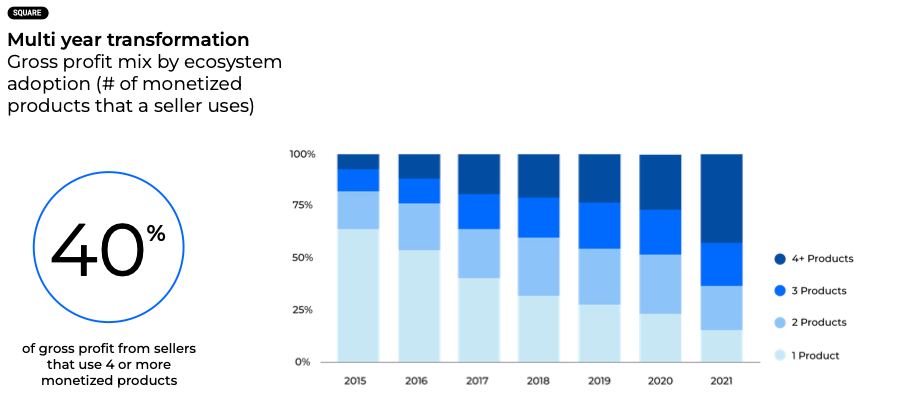

This is well illustrated through a platform like Square: Based on the plethora of payments that come through a business, Square can more effectively push and develop products for its users that are better tailored to their needs

This is further evidenced by the strong attach rates of Square’s business services (see here)

This also extends across the economy: almost always, businesses with high attach rates (i.e., businesses with an ability to “upsell” are almost always businesses with higher signal liquidity)

For example, if we think of linear-TV operators, those who see higher percentages of customers gravitating to higher-priced packages are often those who have designed such packages in a way that reflects their customers’ needs better

With signal liquidity and an effective engine to translate these products into unique and personalized deliverables for the end user, businesses increase the switching costs of their platform

That is, if I’m using a platform that’s providing me with value, I shouldn’t need to go to another platform to seek it

This is also well illustrated with “xPaaS” (i.e., “xyz” platform as a service) or “one-stop shop” businesses – if there are more services offered on a network, the substitutability of that network is much lower

High switching costs translate to higher retention, which should translate into positive network effects for a platform

If more people like a platform and stay on a platform, they should (in theory) encourage others to get on the platform

The point here is that collecting data is not enough. What matters more than data collection is how short the feedback loop is between collection and distribution. The shorter a business’ feedback loop is, the sticker users are on the platform. Think of a business like Stitch Fix, the premise is simple:

I collect data on your clothing preferences

I parse this data and provide you with samples that are interesting

I recognize what you like and don’t like and send you new clothes accordingly

This whole process, although value-generating to the end user, is far too long to really achieve what I would consider “escape velocity.” Yes, collecting data itself is good, but it’s not enough.

When thinking about the compounders of the future, businesses that have the combination of high signal liquidity, the ability to translate said signals into higher switching costs, and the benefit of network effects will be those that are most successful. As such, platforms that produce content that is shorter and easier to digest will almost always be better at pulling our attention away than their longer-form peers.2

DISCLAIMER

The content provided on the “Sanjay’s Substack” newsletter is for general informational purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and professional advice before making any investment decision. Always perform your own due diligence.

I truly deserve no credit for coining this term, @profgalloway does.

I understand there may be significant consequences that arise from the proliferation of short-form video content. The rise of TikTok is merely a proof-of-concept for the power of building businesses with a focus on Signal Liquidity. Regardless of the normative consequences of this trend, thinking about businesses from the perspective of how they increase switching costs and capitalize on signals I think is a useful framework for understanding why they are successful.